President Joe Biden has proposed a $4.1 trillion economic agenda to be enacted this year.

This two-part agenda is composed of the $2.3 trillion American Jobs Plan, focused on upgrading critical infrastructure (e.g. roads, bridges, the electrical grid, water treatment plants, etc.), expanding broadband access, revitalizing manufacturing, retrofitting and modernizing privately- and publically-owned buildings, and creating good-quality jobs.

The second component of the President’s economic agenda is the $1.8 trillion American Families Plan that seeks to expand and improve early and postsecondary education, invest in teacher education and preparation, provide direct financial support to families with children, advance accessible and high-quality child care, and upgrade paid leave and nutritional support policies.

To finance this agenda, President Biden proposes sweeping changes to the current tax code. The President has promised not to alter income taxes for those earning less than $400,000 annually, but it is expected that the top marginal rate will be increased from 37% to 39.6%. Corporate taxes could rise from 21% to 28% with a 15% minimum on book corporate income.

Most significant, however, for investors are the suggested changes to capital gains taxation.

What Are Capital Gains Taxes?

The capital gains tax is a tax assessed on the profit earned when individuals or corporations sell capital assets. Capital assets include, but are not limited to, stocks and bonds, business assets, precious metals, real estate, antique cars and other collectibles, art, and jewelry.

The tax does not apply to the increase in value of unsold investments, which is known as “unrealized capital gains.” It only applies when assets are sold for a profit, at which point, the capital gains are “realized.”

Capital losses, on the other hand, occur when a capital asset is sold for less than the price at which its owner purchased it. Taxable capital gains are the net capital gain, calculated by subtracting capital losses from capital gains incurred in that year. This figure, along with filing status, determines the tax rate assessed.

Capital gains taxes can be assessed at the Federal and state level. There are several states that tax neither income nor capital gains:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

For the sake of simplicity, we will focus on a generalized case of the capital gains taxes associated with the sale of stocks and bonds. Other capital assets are taxed according to another subset, or overlapping subsets, of tax codes with variable tax brackets.

Short-Term Capital Gains Versus Long-Term Capital Gains

It must be noted that short-term capital gains and long-term capital gains currently receive different tax treatment.

Short-Term Capital Gains Taxes

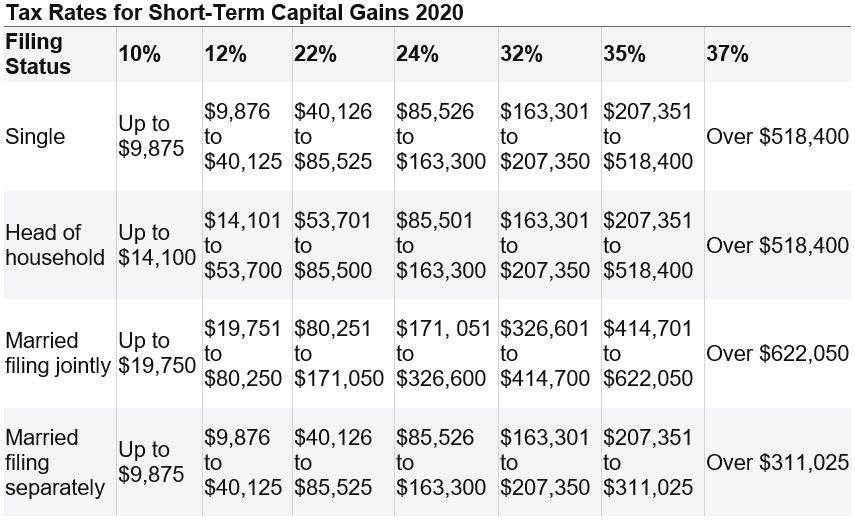

Short-term capital gains are realized when the seller of a capital asset has held it for one year or less. These gains are taxed as regular income according to the following schedule:

Source: Investopedia[1]

It is possible under the current tax code that a portion of one’s total income will be taxed at a higher rate if the amount of the short-term capital gain pushes the tax filer’s income into a higher tax bracket. As such, regular income, plus the portion of the capital gains that brings total income to the threshold level, is taxed at the lower rate; and, the additional short-term capital gains are taxed at higher rate.

As we shall see, the 2020 tax code typically taxes short-term capital gains at a higher rate than long-term capital gains.

Long-Term Capital Gains Taxes

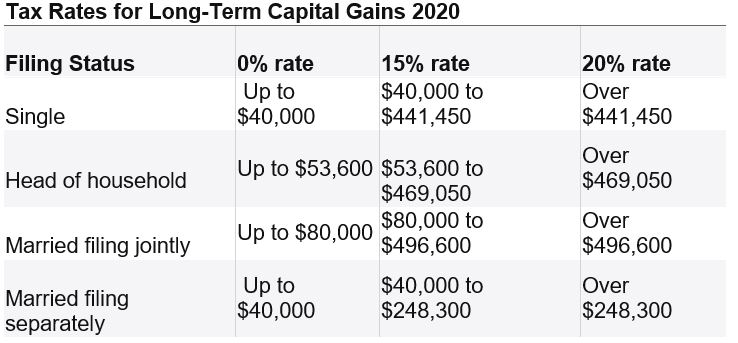

When a capital asset owner sells that asset after holding it for more than a year, a long-term capital gain is realized. The following schedule shows the current Federal long-term capital gains tax rates prior to the addition of possible state-level capital gains taxes:

Source: Investopedia

Comparing the two tax schedules, we can see that the capital gains tax is almost always lower on long-term capital gains, encouraging investors to hold their assets for more than a year.

The schedules here represent the tax code instituted under former-President Donald Trump’s Tax Cuts and Jobs Act, that took effect January 1, 2017, with tax brackets indexed for inflation. Prior to that, former-President Obama’s tax policy had also assigned tax rates of 0%, 15%, and 20% to long-term capital gains although the determination of tax brackets differed.

The Net Investment Income Tax And Capital Losses

Finally, we must consider two other significant topics with respect to taxes.

The first is the Net Investment Income Tax (NIIT) instituted in 2010. This is a 3.8% tax applied to the net investment income of certain individuals, estates, and trusts.

With respect to individuals, the NIIT is assessed when either net investment income, or modified adjusted gross income (MAGI), surpasses IRS-imposed thresholds, the lesser amount taking precedence.

NIIT thresholds are represented in the following table:

|

Net Investment Income Tax (NIIT) Thresholds |

||||

|

Your Filing Status |

Threshold Amount |

|||

|

Single |

$200,000 |

|||

|

Married Filing Jointly |

$250,000 |

|||

|

Married Filing Separately |

$125,000 |

|||

|

Head of Household (With Qualifying Person) |

$200,000 |

|||

|

Qualifying Widow(er) With Dependent Child |

$250,000 |

|||

Source: smartasset[3]

It follows that a high-earning investor would pay the NIIT on top of long-term capital gains tax. So, for example, the top marginal long-term capital gains tax would be 23.8%. This tax came into effect January 1, 2013 as part of the Health Care and Education Reconciliation Act of 2010 and has remained unchanged since then.

The second topic and final significant topic that we must address, before turning to new tax policy proposals, is capital losses and their tax implications.

If, in a given year, an investor experiences a net capital loss, then the investor can claim a limited deduction on the loss to lower taxable income. The maximum deduction is capped at $3,000 (or $1,500 for those married and filing separately), and the investor may carry forward any additional losses to later years.

For example, if an investor incurs capital losses of $12,000, then she may claim a net loss of $3,000 in that year. The remaining $9,000 of capital losses is carried over so that she may claim losses of $3,000 in the following three years (i.e. $3,000 x 3 = $9,000).

Now, having laid out the current state of capital gains taxes as they presently stand, we may turn to some of President Biden’s tax proposals that may affect current investors, particularly those who realize large long-term capital gains.

Possible Changes To Long-Term Capital Gains Taxation

The most salient feature of President Biden’s proposed tax policy is the creation of a new tax bracket on the long-term capital gains tax schedule that would apply to capital gains of $1,000,000 or more.

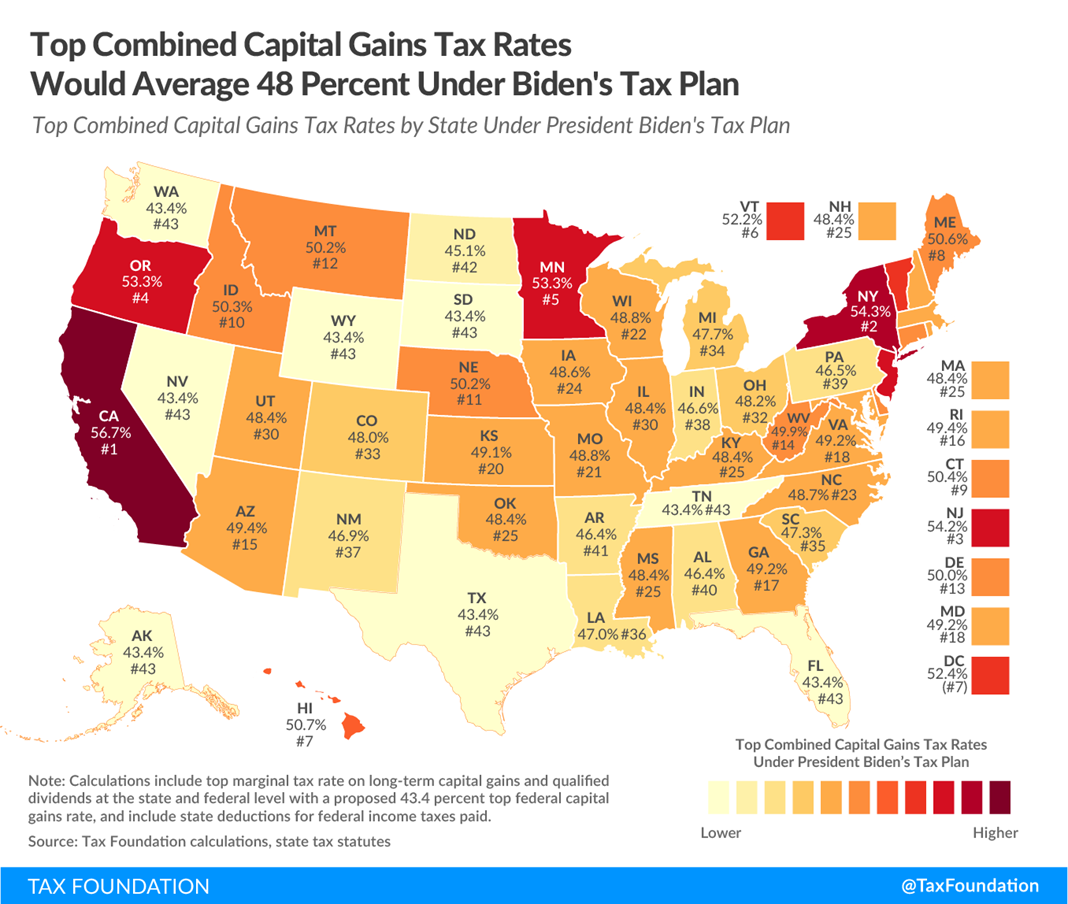

This rate would coincide with the proposed top marginal income tax rate at 39.6%. Assuming that the NIIT is still imposed as it is currently, the top total capital gains tax would be 43.4% before state taxes. Adding in state long-term capital gains taxes, the tax on gains of $1,000,000+ would average out to approximately 48%. Capital gains taxes would range from the base rate of 43.4% in states with no capital gains tax to 56.7% in California and 54.3% in New York, the states with the highest capital gains tax rates.

The following map shows predicted tax rates on a state-by-state basis:

Source: Tax Foundation[4]

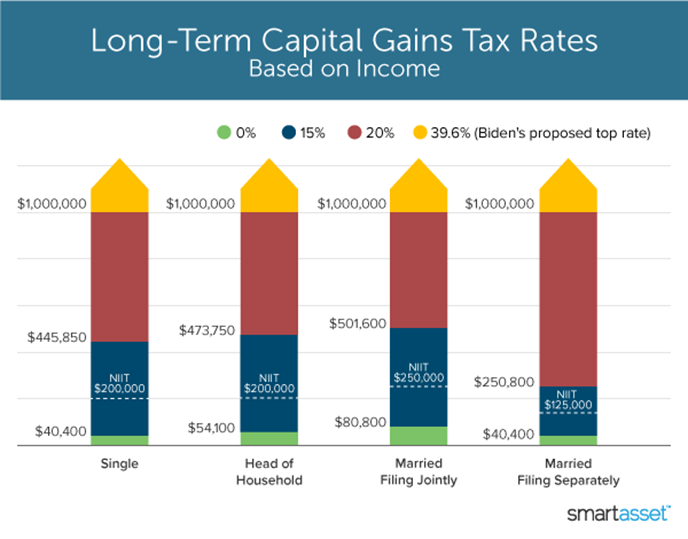

The Biden tax plan would account for the creation of this new tax bracket by adjusting upward long-term capital gains cut-offs at each currently existing level of taxation.

This graphic depicts projected 2021 long-term capital gains tax brackets with the NIIT thresholds included for each filing status:

Source: smartasset[5]

It is worth noting that taxes on short-term capital gains and long-term capital gains on gains of $1,000,000 or more would equalize under President Biden’s plan since the top marginal tax rate on ordinary income (as previously noted, the rate at which short-term capital gains are taxed) and the top capital gains tax rate would both equal 39.6% before the addition of NIIT and state taxes.

Other changes to long-term capital gains taxation seek to close existing loopholes, such as the carried interest loophole and the stepped-up basis loophole. Generally speaking, eliminating these loopholes would result in imposing the newly created top marginal capital gains tax rate on high earners, generating significant additional revenue for the Federal government, ceteris paribus.

Conclusion

This article gives only a generalized overview of the current capital gains tax regime and the anticipated changes that will occur with the enactment of President Biden’s proposed tax plan. By no means can anyone claim certainty to the concrete details of the exact policy that will be signed in to law.

Furthermore, tax codes are exceedingly complex and nuanced. The entire United States tax code, including statutes, regulations, and case law, is 70,000 pages long. Therefore, it is important for investors to consult a range of financial specialists when considering the tax implications of their investments.

The knowledge and expertise of the advisers at Black Iron Advisers makes them an invaluable resource in planning your investing strategy. Their in-depth market insight, vast intra-industry network of connections, and broad execution capabilities will help you achieve your investing goals in today’s dynamic investing environment. For further information, please contact Black Iron Advisers today.

[1] Boyte-White, Claire. “Understanding Long-Term vs. Short-Term Capital Gains.” Investopedia, 14 May 2021, investopedia.com/articles/personal-finance/101515/comparing-long-term-vs-short-term-capital-gains-rates.asp. Accessed 19 May 2021.

[2] ibid.

[3] Thompson, Chris. “What Is the Net Investment Income Tax?” smartasset, 12 January 2021, smartasset.com/investing/net-investment-income-tax. Accessed 19 May 2021.

[4] Watson, Garrett and Erica York. “Top Combined Capital Gains Rates Would Average 48 Percent Under Biden’s Tax Plan.” Tax Foundation, 23 April 2021, taxfoundation.org/biden-capital-gains-tax-rates. Accessed 19 May 2021.

[5] Conde, Arturo. “Inside Biden’s Capital Gains Tax Plan.” smartasset, 17 May 2021, smartasset.com/taxes/bidens-capital-gains-tax. Accessed 19 May 2021