There is a growing wave of concern how accelerating electric vehicle (EV) sales in the US will affect the automotive maintenance industry. Headlines declaring that 2021 will be a year of record EV sales do nothing to quell these concerns; nor do statistics showing a 329% increase in EV sales in May 2021 on a year-on-year basis. Predictions that auto maintenance revenues will decline 35% over five years on EVs, as compared to internal combustion engine vehicles (ICE vehicles), are no less hair-raising. What is an auto service center to do? Shut down shop? Sell? Overhaul operations?

Before panic mode sets in, let’s consider the bigger picture when it comes to the increased adoption of EVs. To be clear, the category of electric vehicles considered in totality includes:

- Battery-Electric Vehicles (BEVs) – vehicles solely powered by electricity and have regenerative braking that allows the car to recapture energy when you brake or decelerate

- Plug-in Hybrid Electric Vehicles (PHEVs) – vehicles that run on both electricity and gas, can be plugged in to recharge, and have regenerative braking

- Hybrid Electric Vehicles – vehicles primarily powered by gas with electric capabilities and often have regenerative braking

- Fuel Cell Electric Vehicles – vehicles powered by electricity using a fuel cell powered by hydrogen

We will focus on BEVs as they are the type of vehicle experiencing the most rapid growth in sales, and they are the vehicles most people identify with the term EV.

Reasons For Concern

Before turning to the reasons for optimism, let us first acknowledge the very real reasons why auto center owners may worry about the future of their operations with EV sales growth increasing as a percentage of all new auto sales.

Firstly, EVs eliminate over two dozen mechanical components that would require routine service. Oil changes, tune-ups, transmission servicing, replacing spark plugs and drive belts among other routine services are obsolete when maintaining an EV. The loss of revenue on these periodic services is not insignificant when considering the replacement of ICE vehicles with EVs as a percentage of the vehicles in operation (VIO).

Secondly, regenerative braking obviates the need for typical servicing and brake pad replacement that friction brakes on an ICE vehicle require. Regenerative braking systems use motor resistance to slow the vehicle and send energy back into the battery. Although most EVs still have traditional friction brakes, they tend to last much longer if the driver adapts their driving habits to rely on the regenerative system rather than slamming on the brakes. Furthermore, the friction brakes work in tandem with the regen brakes, lessening the wear on the brake pads overall. EVs typically can travel over 100,000 miles without having to replace the brakes, whereas ICE vehicles generally need brake pad replacement every 30,000 miles. The recurring revenue losses on brake services for an EV, though not as significant as the losses on other maintenance services, is not inconsequential.

Reasons for Optimism

Although the prospect of an EV takeover may seem daunting to auto center owners, it is essential to take a broad view of the market for new car sales as well as the ratio of EVs in operation to ICE-vehicles in operation.

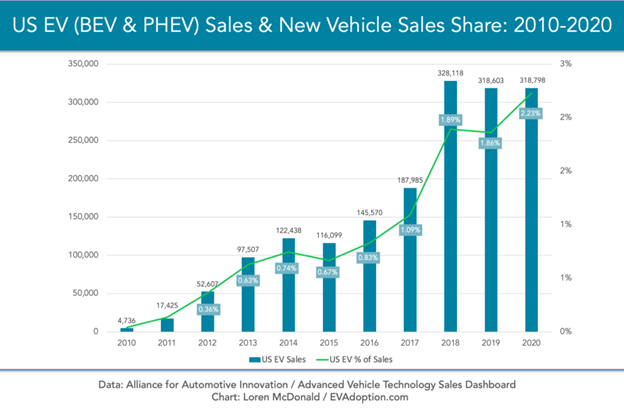

The number of BEVs registered in the US has increased from 300,000 in 2016 to 1.1 million in 2020; however, BEV and PHEV sales have accounted for only approximately 2% of all new cars sold since 2018 as shown below.

Source: evadoption[1]

The US has been slower to adopt EVs than European countries, for instance, for manifold reasons, but there are several major ones to consider:

- Preference for SUVs and large trucks.

Currently there are few offerings when it comes to EVs that are not light passenger vehicles.Tesla, Hummer, Ford, and innovative new manufacturers such as Hercules are all bringing new models to market to fill this gap.

- Inexpensive gasoline and fuel-efficient ICE vehicles reduce the economic pressure to switch to EVs.

- EVs are generally more expensive at point of purchase than ICE vehicles, pricing many consumers out of the market.

- Preference for long-distance travel.

Although battery life keeps improving in EVs, the most recent models generally require charging after about 200 miles.Standard ICE vehicles can often travel 250-300 miles before refueling, and fuel-efficient models may go over 400 miles.

- Few government mandates with respect to emissions or ICE vehicle sales.

Several states including California, Massachusetts, and New York have or are considering legislation that would restrict all new car sales to zero emission vehicles by 2035.

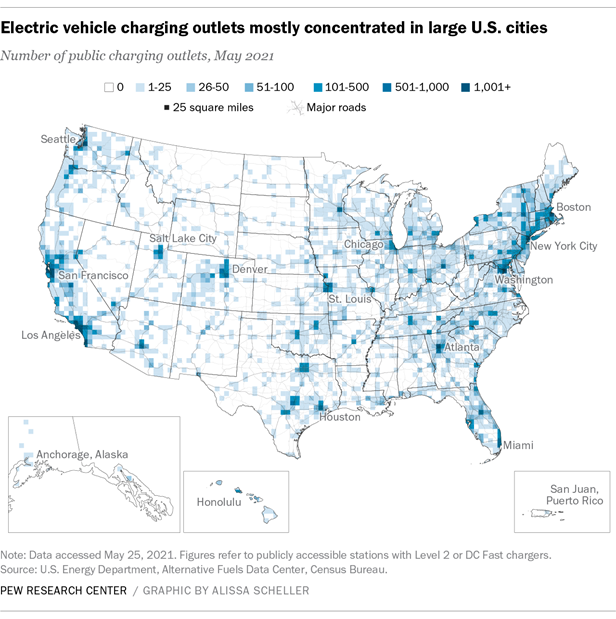

- Lack of charging stations in many areas.

Additional hindrances to EV adoption are microchip shortages, battery recalls, supply chain issues, and factory and production delays. Microchip shortages have especially affected new car sales in 2021, driving up the price of all new vehicles. Consumers are turning to the used vehicle market as an alternative even though prices are surging in that market as well.

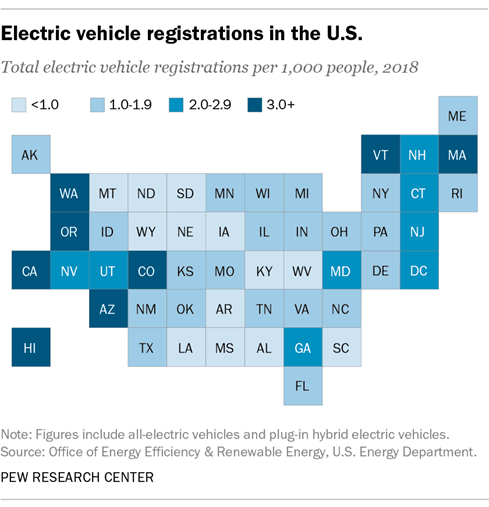

Nationwide, we observe a great disparity in the rates of EV registration in different states. The graphic below reflects data collected in 2018 pertaining to BEV and PHEV registration rates in each state. The rates shown here reflect current rates of EV purchase.

Source: Pew Research Center[2]

While all the factors listed above contribute to the variation in rates across states, government mandates and the availability of charging stations are the most salient. Whether the mandates to end non-zero emission vehicle sales and availability of charging stations prompted the adoption of EVs or vice versa, it is most probable that the phenomena are mutually reinforcing. As evident in the graphic below, as of May 2021, EV charging stations are most concentrated in regions where the registration rates of EVs in operation are highest.

Source: Pew Research Center[3]

The previous data shows that the transition to EV usage is relatively slow and mostly concentrated in few regions. All data considered, shouldn’t the arrival of EVs be the death knell of the auto maintenance industry as we know it? Wouldn’t it be best just to close shop in New York city or San Francisco and concentrate one’s resources on the Midwest?

The answer is a definitive no. For one, EVs still require maintenance, just not of the exact same variety as ICE vehicles. But, secondly, and most importantly, the number of ICE vehicles in use is only expected to grow. Not only are ICE vehicles remaining functional longer than previous generations of ICE cars and becoming more fuel efficient, but the growing trend of telecommuting is also extending the lifespan of vehicles since fewer miles of travel are demanded of a car on a weekly basis.

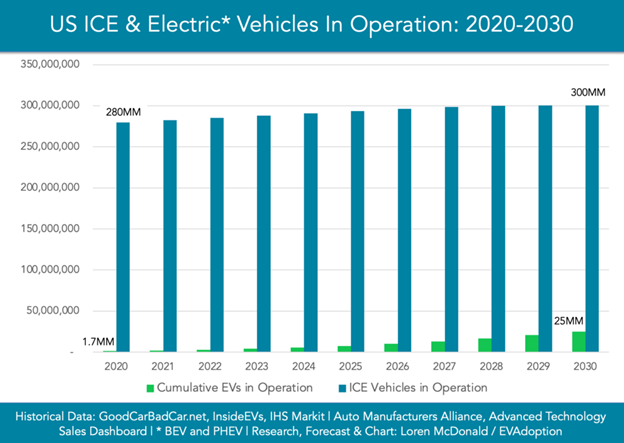

The expansion of telecommuting has also accelerated because of the COVID-19 pandemic. Individuals are, therefore, less likely to feel enough economic pressure to switch to an EV. If they do purchase an EV, chances are that they still may own an ICE vehicle in operating condition. Although EVs may continue to increase as a percentage of new car sales, they are expected to remain a minor portion of the VIO. The following graphic shows the anticipated numbers of VIO through 2030.

Source: evadoption[4]

Given the predicted changes in the VIO over the next decade, auto center owners can generally expect an increase in revenue. EV ownership is and will be relegated to a few specific regions; and, even then, EVs will not supplant the use of ICE vehicles for many years to come. Barring extreme conditions, particularly with respect to government legislation, the transition to an EV dominant market should be gradual.

EVs are expected to become the future of all new light passenger vehicles, but ICE vehicles – especially larger vehicles – will by no means disappear. By 2040, current projections suggest that about 30% of new vehicle sales in the U.S. will be EVs. Thus, the numbers indicate that one should expect to see an increasing number of fuel-efficient ICE vehicles on the road. Traditional auto services will remain in increasing demand as the absolute number of VIO increases as well.

Some services are simply impervious to any change in the composition of VIO. Auto body repair, interior customization, auto restoration, and parts replacement are just a few fields where consumer demand will remain stable.

The long of the short is that auto centers will continue to play a very important role in vehicle maintenance for the foreseeable future. The transition toward EV-oriented services will take place gradually over time, allowing auto center owners to adjust their operations as necessary. Certain regions will require a more substantial shift toward EV maintenance than others. However, the demand for ICE vehicle maintenance will not disappear overnight and, in fact, may increase if the average age of VIO increases.

Areas for Growth[5]

The transition toward EV ownership does present several opportunities for growth in certain areas of auto maintenance.

For one, EVs tend to consume tires at a much higher rate than ICE vehicles. They are heavier and their engines have much more near-instant higher torque than traditional ICE vehicles, so they require more frequent tire replacement. Generally speaking, EV owners need tire replacement 30% more frequently than ICE vehicle owners.

Secondly, services pertaining to visibility will increase. Sensors and cameras are becoming more and more important in the functioning of modern vehicles, be they EVs or traditional ICE vehicles. Regardless, the information from these additions to on-board technology are worthless unless they are kept clean.

It is also important to acknowledge that current visibility technologies work alongside and enhance previous visibility technologies. Wipers, cleaning fluids, headlights, and bulbs have always been important to safe vehicle operation. The addition of sensors and cameras simply enhances driver safety as well as the opportunity for auto maintenance centers to capitalize on the upkeep of essential safety technology.

New EVs also tend to be equipped with larger windshields and moonroofs. It is probable that these structures will need replacement as more efficient materials become available to prevent thermal losses. Currently, Tesla’s panoramic Model X glass cost $2,300 to replace, so this sector of the glass maintenance market should not be ignored and may positively sway revenues compared to those incurred by traditional ICE vehicles.

Conclusion

That EVs are coming is a fact. They will require that existing automotive maintenance businesses adapt. However, the shift toward EV presence with respect the totality of VIO will be gradual. Many ICE vehicles will remain in operation for decades to come, and consumer preference will ultimately dictate the types of vehicles on the road. Regardless, the absolute number of vehicles on the road will continue to increase, and the need for auto services will remain despite the exact nature of these services.

If you are interested in discovering new opportunities in the auto center industry, please contact Black Iron Advisers here. Black Iron Advisers brings high caliber investment banking expertise to the auto center industry. Black Iron Advisers specializes in sell-side and buy-side representation of franchised and independent auto centers.

Black Iron Advisers was founded with a client first philosophy. To ensure that our only priority is maximizing value for you, we don’t accept kickbacks from lenders or fees from buyers.

For more information, please contact us here.

[1] McDonald, Loren. “2030: 20 Million More ICE Vehicles Will Be on the Roads in the US Than in 2021.” evadoption. www.evadoption.com/2030-20-million-more-ice-vehicles-will-be-on-the-roads-in-the-us-than-in-2021.

[2] DeSilver, Drew. “Today’s electric vehicle market: Slow growth in U.S., faster in China, Europe.” Pew Research Center. www.pewresearch.org/2021/06/07/todays-electric-vehicle-market-slow-growth-in-u-s-faster-in-china-europe.

[3] Ibid.

[4] McDonald, Loren. “2030: 20 Million More ICE Vehicles Will Be on the Roads in the US Than in 2021.” evadoption. www.evadoption.com/2030-20-million-more-ice-vehicles-will-be-on-the-roads-in-the-us-than-in-2021.

[5] Brennan, Reilly. “Electric vehicles are changing the future of auto maintenance.” TechCrunch. www.techcrunch.com/2020/03/06/electric-vehicles-are-changing-the-future-of-auto-maintenance.